It may come as a surprise to investors that financial advice has historically tended to have little relationship to their goals. Rather, it has had much more to do with how comfortable an investor is with a particular product.

The outcome has been unfulfilled expectations for investors and damaged the financial planning industry’s reputation.

But the industry is slowly changing.

A shift is underway, moving client objectives to the forefront of the advice process rather than building advice on compliance-driven measures, aimed at minimising internal business risk.

An over-dependence on risk tolerance

An investor’s risk tolerance has formed the central building block of most financial planning advice. This is often a simple measure of how an investor is likely to react to swings in the market.

Aggressive investors are most likely to be recommended growth investments such as shares while more conservative investors (who are more likely to sell after a big market downturn) are most likely to be recommended defensive investments such as bonds or cash.

This risk profile provides a paper trail which, at least superficially, satisfies businesses’ compliance requirements. Unfortunately, this compliance-led advice pathway has little to do with an investor achieving his or her goals. Arguably, this is the key service that financial advice is supposed to deliver.

Not surprisingly, fewer Australians feel strong confidence in their ability to achieve their financial life goals compared to globally (16% versus 22%), according to a study last year by the Financial Planning Standards Board (FPSB) and the Financial Planning Association of Australia (FPA).

More concerning for the industry, the study found that fewer Australians turn to a financial planner (23% versus 31% globally) while more Australians don’t know who to trust (70% compared to 66% globally).

Real advice: the tension between risk capacity and risk tolerance

While an investor’s risk tolerance is an important measure, so, too, is his or her risk capacity. Risk tolerance is a measure of what investors can withstand emotionally while risk capacity is a measure of how much risk they can (or should) take in order to achieve their goals.

Introducing this measure into the advice process brings an entirely different focus. A product is just one potential component of a broader, holistic strategy, which is directly tied to an investor’s personal goals, not just levels of personal comfort.

It also introduces a level of tension where real advice – and difficult discussions – begin.

For example, let us look at a hypothetical 65-year-old investor, Peter, who has just retired with $500,000 in superannuation savings.

He told his adviser that he wants to withdraw an annual pension income of $30,000 from his savings. At the same time, he has a low risk tolerance and doesn’t want to experience market uncertainties.

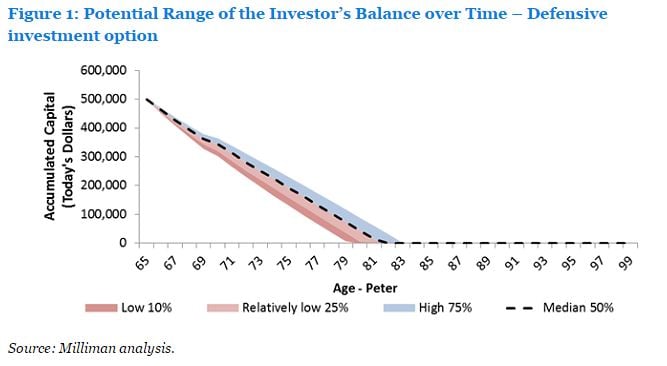

The adviser should be able to have a discussion with him that, given his situation, his retirement objective and risk capacity conflicts with his risk tolerance, because if he invests in a safe investment option (in accordance with his risk tolerance) split 80:20 between defensive and growth assets, he will only have a 3% probability of being able to sustain his target income to his life expectancy of 86 years.

We see that Peter will have a high certainty about his retirement outcome. Unfortunately, it is a high certainty that he will fail to achieve his stated goals.

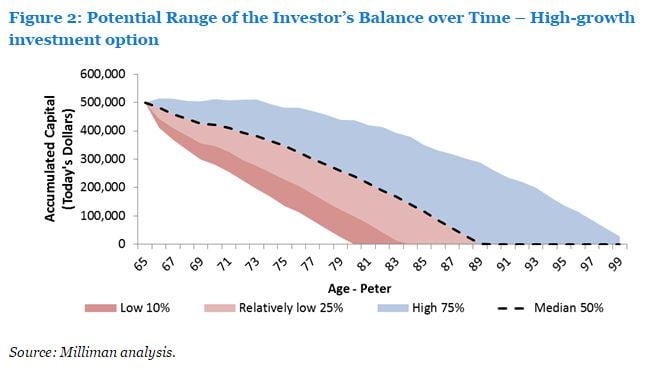

To be able to achieve his retirement goals, he will need to take on a lot more risk and actually invest in a high-growth option (with a 90% growth asset allocation).

As we see in the above chart, he will have highly uncertain retirement outcomes, but in 54% of scenarios, he will be able to sustain the target income to at least his life expectancy.

This is a simple example where the investor’s measured risk tolerance does not match his risk capacity – in this case, the need to take on more risk. The investor with limited savings cannot afford to invest conservatively or he will almost certainly not achieve his goals.

This expectations gap can be modelled and measured with a range of sophisticated tools. Interestingly, risk tolerance could also be redefined within such a framework to incorporate measures of how the investor might react emotionally should he fail to meet his goals.

Good financial planners can play a key role here to help investors understand their options, nudging them towards the financial and lifestyle changes they require if they are to reach their goals. This is not easy territory – but it is the realm of genuine advice. With this knowledge, investors can start to make necessary changes well before they are knocking on the door to retirement.

The article was first published on Milliman website.

Disclaimer

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.

© 2016 MILLIMAN PTY LTD